BELOW WILL BE THE VIDEO

Thursday, April 13, 2017

FRQ SCENERIO 5

This video will help the students understand how the question should be solved.

BELOW WILL BE THE VIDEO

BELOW WILL BE THE VIDEO

Tuesday, April 11, 2017

The Money Market

Demand for money has an inverse relationship between nominal interest rates and the quantity of money demanded

What happens to the quantity demanded of money when interest rates increases?

Quantity demanded falls because individuals would prefer to have interest earning assets instead of borrowed liabilities

What happens to the quantity demanded when interest rates decrease?

Quantity demanded increases. there is no incentive to convert cash into interest earning assets.

Money Demand Sifters:

Change in price level

Changes in income

Changes in taxation that affects investment

- If the FED increases the money supply, a temporary surplus of money will occur at 5% interest.

- The surplus will cause the interest rate to fall to 2%.

- The discount rate is the interest rate that the FED charges commercial banks for short terms loans

- Is the private sector supply and demand of loans\

- This market brings together the lenders and the borrowers

- This market shows effect on Real Interest rate

- Demand- Inverse relationship between real interest rate and quantity loan supplied

- Supply- Direct relationship between real interest rate and quantity loans supplied

- This is Not the same as the money market ( SUPPLY IS NOT VERTICAL)

Money Supply:

Increase money supply TO decreases interest rates TO Increases investments

Federal Fund Rate

- It is the interest rate that banks charge one another for over night loans

The Prime Rate

- It is the interest rate that banks charge there most credited customers

VIDEO ABOVE WILL HELP AS AN OVERVIEW OF THIS COURSE

Stocks and Bonds

April 3, 2017

Stock and Bonds

· Stocks you own

· Bonds are loans, or IOUs, that represents debt that the government or a corporation must repay to an investor, the bond holder no ownership

Bonds

· How are they determined

- First: if a corporation issues and then sells a bond; this is a liability for the corporation and an asset for the buyer.

· If nominal interest rate falls-value of the bond increases

· If the nominal interest rises – then the value decreases

Stocks

· Earn money by

Dividends- which are portions of a corporations profits ,are paid out to stockholders (interest)

- The higher the corporation profit, the higher the dividend

- A capital gain- is earned when a stockholder sells stocks for more than he or she paid for it.

- A stockholder that sells stocks at a lower price than the purchase price suffers a capital loss

BELOW WILL HELP OVERVIEW THIS COURSE

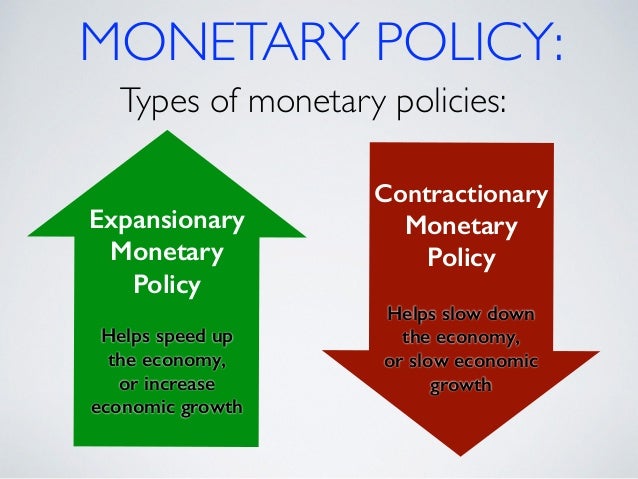

Monetary Policy

March 31, 2017

3 tools of monetary policy

1. Reserve Requirement: If you have a bank account, where is your money?

The FED sets the amount that banks must hold

The reserve requirement (reserve ratio) is the percent of deposits that banks must hold in reserve (the percent they can not loan out)

2. Open Market Operations (OMO): when the FED buys or sells government bonds/securities

3 tools of monetary policy

1. Reserve Requirement: If you have a bank account, where is your money?

The FED sets the amount that banks must hold

The reserve requirement (reserve ratio) is the percent of deposits that banks must hold in reserve (the percent they can not loan out)

- bank deposits- when someone (public or private) deposits money in the bank

- banks keep some of the money in reserve and loans out their excess reserves

- The loan eventually becomes deposits for another bank that will loan out their excess reserves

If there is a recession:

Decrease the Reserve Ratio

- Banks hold less money and have more excess reserves

- Banks create more money by loaning out excess

- Money supply increases, interest rates fall AD goes up

If there is an inflation:

Increase the Reserve Ratio

- Banks hold more money and have less excess reserves

- Banks create less money

- Money supply decreases, interest rates up, AD down

2. Open Market Operations (OMO): when the FED buys or sells government bonds/securities

- This is the most important and widely used monetary policy

- If the fed BUYS bonds- takes out bonds from economy and replace with money MS (up)

- IF the fed SELLS bonds - takes the money and gives the security to the investor. MS (down)

3. Discount Rate: MANY different interest rates, but they tend to all rise and fall together

- It is the interest rate that the FED charges commercial banks for short-term loans.

Federal Funds Rate: the interest rate that bank charges another for overnight loans

VIDEO BELOW WILL BE AN OVER VIEW OVER THIS COURSE

Subscribe to:

Comments (Atom)