How does the Government Stabilize the Economy?

Fiscal Policy - Actions by Congress to stabilize the economy

changes in the expenditures or tax revenues of the federal government

2 tools of the Fiscal policy:

Taxes- government can increase or decrease taxes

Spending- government can increase or decrease spending

Fiscal Policy is enacted to promote our nation's economic goals: full employment, price stability, economic growth

Deficits/Budgets/Surplus

Balanced budget

Revenues = Expenditures

Budget deficit

Revenues < Expenditures

Budget surplus

Revenues > Expenditures

Government debt

Sum of all deficits - Sum of all surpluses

Government must borrow money when it runs a budget deficit

Government borrows from:

- Individuals

- Corporations

- Financial Institutions

- Foreign entities or foreign governments

Fiscal Policy Two Options

- Discretionary Fiscal Policy (action)

-Expansionary fiscal policy - think deficit

-Contractionary fiscal policy - think surplus

- Non-Discretionary Fiscal Policy (no action)

Three types of Taxes

1.Progressive Taxes - takes a larger percent of income from high-income groups (takes more from rich people) Ex: Current Federal Income Tax System

2. Proportional Taxes (flat rate) - takes the same percent of income from all income groups. Ex: 20% flat income tax on all income groups

3. Regressive Taxes - takes larger percentage from low-income groups (takes more from poor people) Ex: Sales tax; any consumption tax

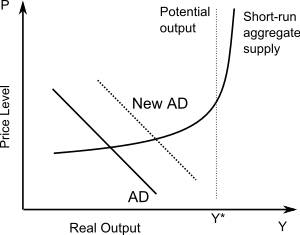

Contractionary Fiscal Policy

- Laws that reduce inflation, decrease GDP

(Close a Inflationary Gap)

- Decrease Government Spending

- Tax Increases

- Combinations of the Two

Expansionary Fiscal Policy

- Laws that reduce unemployment and increase GDP

(Close a Recessionary Gap)

- Increase Government Spending

- Decrease Taxes on consumers

Automatic or Built-In Stabilizers

- Anything that increases the government's budget deficit during a recession and increases its budget surplus during inflation without requiring explicit action by policymakers

Transfer Payments

- Welfare checks

- Food Stamps

- Unemployment checks

- Corporate dividends

- Social Security

- Veteran's benefits