BELOW WILL BE THE VIDEO

Mansoor's AP Macroeconomics Blog

Thursday, April 13, 2017

FRQ SCENERIO 5

This video will help the students understand how the question should be solved.

BELOW WILL BE THE VIDEO

BELOW WILL BE THE VIDEO

Tuesday, April 11, 2017

The Money Market

Demand for money has an inverse relationship between nominal interest rates and the quantity of money demanded

What happens to the quantity demanded of money when interest rates increases?

Quantity demanded falls because individuals would prefer to have interest earning assets instead of borrowed liabilities

What happens to the quantity demanded when interest rates decrease?

Quantity demanded increases. there is no incentive to convert cash into interest earning assets.

Money Demand Sifters:

Change in price level

Changes in income

Changes in taxation that affects investment

- If the FED increases the money supply, a temporary surplus of money will occur at 5% interest.

- The surplus will cause the interest rate to fall to 2%.

- The discount rate is the interest rate that the FED charges commercial banks for short terms loans

- Is the private sector supply and demand of loans\

- This market brings together the lenders and the borrowers

- This market shows effect on Real Interest rate

- Demand- Inverse relationship between real interest rate and quantity loan supplied

- Supply- Direct relationship between real interest rate and quantity loans supplied

- This is Not the same as the money market ( SUPPLY IS NOT VERTICAL)

Money Supply:

Increase money supply TO decreases interest rates TO Increases investments

Federal Fund Rate

- It is the interest rate that banks charge one another for over night loans

The Prime Rate

- It is the interest rate that banks charge there most credited customers

VIDEO ABOVE WILL HELP AS AN OVERVIEW OF THIS COURSE

Stocks and Bonds

April 3, 2017

Stock and Bonds

· Stocks you own

· Bonds are loans, or IOUs, that represents debt that the government or a corporation must repay to an investor, the bond holder no ownership

Bonds

· How are they determined

- First: if a corporation issues and then sells a bond; this is a liability for the corporation and an asset for the buyer.

· If nominal interest rate falls-value of the bond increases

· If the nominal interest rises – then the value decreases

Stocks

· Earn money by

Dividends- which are portions of a corporations profits ,are paid out to stockholders (interest)

- The higher the corporation profit, the higher the dividend

- A capital gain- is earned when a stockholder sells stocks for more than he or she paid for it.

- A stockholder that sells stocks at a lower price than the purchase price suffers a capital loss

BELOW WILL HELP OVERVIEW THIS COURSE

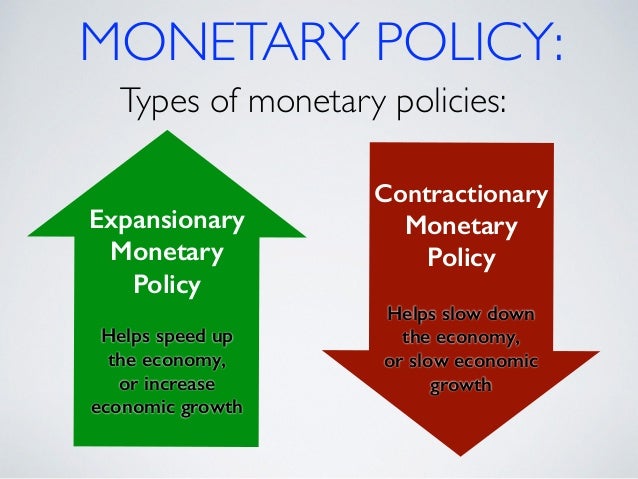

Monetary Policy

March 31, 2017

3 tools of monetary policy

1. Reserve Requirement: If you have a bank account, where is your money?

The FED sets the amount that banks must hold

The reserve requirement (reserve ratio) is the percent of deposits that banks must hold in reserve (the percent they can not loan out)

2. Open Market Operations (OMO): when the FED buys or sells government bonds/securities

3 tools of monetary policy

1. Reserve Requirement: If you have a bank account, where is your money?

The FED sets the amount that banks must hold

The reserve requirement (reserve ratio) is the percent of deposits that banks must hold in reserve (the percent they can not loan out)

- bank deposits- when someone (public or private) deposits money in the bank

- banks keep some of the money in reserve and loans out their excess reserves

- The loan eventually becomes deposits for another bank that will loan out their excess reserves

If there is a recession:

Decrease the Reserve Ratio

- Banks hold less money and have more excess reserves

- Banks create more money by loaning out excess

- Money supply increases, interest rates fall AD goes up

If there is an inflation:

Increase the Reserve Ratio

- Banks hold more money and have less excess reserves

- Banks create less money

- Money supply decreases, interest rates up, AD down

2. Open Market Operations (OMO): when the FED buys or sells government bonds/securities

- This is the most important and widely used monetary policy

- If the fed BUYS bonds- takes out bonds from economy and replace with money MS (up)

- IF the fed SELLS bonds - takes the money and gives the security to the investor. MS (down)

3. Discount Rate: MANY different interest rates, but they tend to all rise and fall together

- It is the interest rate that the FED charges commercial banks for short-term loans.

Federal Funds Rate: the interest rate that bank charges another for overnight loans

VIDEO BELOW WILL BE AN OVER VIEW OVER THIS COURSE

Friday, March 10, 2017

Fiscal Policy

March 6, 2017

How does the Government Stabilize the Economy?

Fiscal Policy - Actions by Congress to stabilize the economy

changes in the expenditures or tax revenues of the federal government

2 tools of the Fiscal policy:

Taxes- government can increase or decrease taxes

Spending- government can increase or decrease spending

Fiscal Policy is enacted to promote our nation's economic goals: full employment, price stability, economic growth

Deficits/Budgets/Surplus

Balanced budget

Revenues = Expenditures

Budget deficit

Revenues < Expenditures

Budget surplus

Revenues > Expenditures

Government debt

Sum of all deficits - Sum of all surpluses

Government must borrow money when it runs a budget deficit

Government borrows from:

- Individuals

- Corporations

- Financial Institutions

- Foreign entities or foreign governments

Fiscal Policy Two Options

- Discretionary Fiscal Policy (action)

-Expansionary fiscal policy - think deficit

-Contractionary fiscal policy - think surplus

- Non-Discretionary Fiscal Policy (no action)

Three types of Taxes

1.Progressive Taxes - takes a larger percent of income from high-income groups (takes more from rich people) Ex: Current Federal Income Tax System

2. Proportional Taxes (flat rate) - takes the same percent of income from all income groups. Ex: 20% flat income tax on all income groups

3. Regressive Taxes - takes larger percentage from low-income groups (takes more from poor people) Ex: Sales tax; any consumption tax

Contractionary Fiscal Policy

- Laws that reduce inflation, decrease GDP

(Close a Inflationary Gap)

- Decrease Government Spending

- Tax Increases

- Combinations of the Two

Expansionary Fiscal Policy

- Laws that reduce unemployment and increase GDP

(Close a Recessionary Gap)

- Increase Government Spending

- Decrease Taxes on consumers

Automatic or Built-In Stabilizers

- Anything that increases the government's budget deficit during a recession and increases its budget surplus during inflation without requiring explicit action by policymakers

Transfer Payments

- Welfare checks

- Food Stamps

- Unemployment checks

- Corporate dividends

- Social Security

- Veteran's benefits

Consumption and Savings

February 23, 2017

Disposable Income

income after taxes or net income

DI = gross income - taxes

with disposable income, households can either:

consume (spend money on goods and services)

save (not spend money on goods and services)

Consumption

- household spending

- the ability to consume is constrained by:

- the amount of DI

- the propensity to save

Average Propensity to Consume (APC) = % DI that is spent

Saving

- household not spending

- the ability to save is constrained by:

- the amount of DI

- the propensity to consume

Average Propensity to Consume (APS) = % DI not spen

APS + APC = 1

APC > 1 = dissaving

APC = dissaving

Marginal Propensity to Consume (MPC)

- % of every extra dollar earned that is spent

- △C / △DI

Marginal Propensity to Save (MPS)

- % of every extra dollar that is saved

- △S / △DI

MPC + MPS = 1

Determinants of C and S

- wealth

- expectations

- household debt

- taxes

The Spending Multiplier Effect

- an initial change in spending (C, Ig, G, Xn) causes a larger change in aggregate spending, or aggregate demand

Multiplier = △AD / △Spending

Multiplier = AD / △(C, Ig, G, Xn)

Why does this happen?

expenditures and income flow continuously which sets off a spending increase in the economy

The spending multiplier can be calculated from the MPC or the MPS

Multiplier = 1 / 1-MPC or 1 / MPS

Multipliers are (+) when there is an increase in spending and (-) when there is a decrease

Calculating the Tax Multiplier

- when the government taxes, the multiplier works in reverse because now money is leaving the circular flow

- Tax multiplier = -MPC / 1-MPC or -MPC / MPS (It's a negative number)

If there is a tax cut, then the multiplier is (+) because there is now more money in the circular flow

Aggregate Supply

February 21, 2017

Aggregate Supply

The level of new GDP that firms ill produce at each price level

Long run v. Short run

Long run:

Period of time where inputs prices are completely flexible and adjust to changes in the price level

In the long run, the level of real GDP supplied is independent of the price level

Short run:

Period of time where input prices are sticky and do not adjust to changes in the price level

In the short run, the level of Real GDP supplied is directly related to the price level

Long Run Aggregate Supply

The long run Aggregate supply of LRAS marks the level of full employment in the economy

Short Run Aggregate Supply

Because input prices are sticky in the short run, the SRAS is upward sloping

Changes in SRAS

An increase in SRAS is seen as a shift to the right to the right

A decrease in SRAS is seen as a shift to the left. SRAS to the left

The key to understanding shifts in SRAS is per unit cost production

PER- UNIT production cost

Determinants of SRAS ( all of the following affect unit production cost)

Input prices

Domestic resource Price

Wages (75% of all business cost)

Cost of Capital

Raw material (commodity)

Foreign Resource Prices

Strong $= lower foreign resources prices

Weak $= higher foreign resources prices

Market Power

Monopolies and cartels that control resources control the price of those resources

Increase in Resource Prices = SRAS to the left

Decrease in Resource price = SRAS to the right

Productivity

Total output / total inputs

More productivity = Lower unit production cost= SRAS to the right

Lower productivity = higher unit production cost = SRAS to the left

Legal- Institution Environment

Taxes and Subsides

Taxes on business increase per Unit production cost= SRAS to the left

Subsidies to business reduce per unit production cost = SRAS to the right

Government Regulation

Government regulation creates a cost of compliance= SRAS to the left

Deregulation reduces compliance cost = SRAS to the right

Subscribe to:

Comments (Atom)